Climate change risk - A weightier concern than investment risks: How changing risk perceptions can unlock climate action in Africa

Climate change risk - A weightier concern than investment risks: How changing risk perceptions can unlock climate action in Africa

The Africa Regional Resilience Hub, led by SouthSouthNorth (SSN), is a crucial component of the COP28 Resilience Hub. Along with several other regions, the Regional Hubs work to amplify regional voices to global decision-making spaces, with a particular focus on communities and underrepresented and lesser heard voices. This feature forms part of the Africa Regional Hubs efforts in this regard. The COP28 Resilience Hub events are all hybrid and allow for virtual attendance and participation. Register here for the Resilience Hub virtual platform.

This feature is informed by insights and discussions from attendance at the Africa Climate Week 2023, in Nairobi Kenya, where Phatsimo Rahman, from SouthSouthNorth, attended various events relating to climate finance and just transitions. This post first appeared on the SouthSouthNorth website.

In September 2023, the African climate scene was abuzz with discussions and collaborative strategies. The city of Nairobi, Kenya, played host to the inaugural Africa Climate Summit (ACS) and the annual Africa Climate Week (ACW). These meetings attracted diverse stakeholders, from experts and researchers to activists and policymakers, all focusing on a critical agenda: achieving equitable and sustainable development in the face of climate change.

Renewed hope from Nairobi

The summit culminated in the adoption of the “Nairobi Declaration” by African Heads of State and Government. Its primary objective? To underscore Africa's common position in the global climate change process leading at COP 28 and beyond. A consistent theme was the pivotal role of finance, shedding light on the existing unmet multilateral targets, most notably the goal of mobilising USD 100bn per year for developing countries. Another word that echoed throughout most discussions was a four-letter word: ‘risk’. Surprisingly, despite continued mention of this and other key challenges, a palpable sentiment of optimism and determination echoed, and African nations demonstrated a strong resolve to shape their future, though acknowledging the significant financial undertakings this endeavour would require.

The financial landscape and climate initiatives

Africa’s financial needs for combatting climate change effectively stand at an average of 250 billion dollars annually. This colossal sum not only demands monetary commitments but also a paradigm shift in financial strategies and approaches. It prompts the question: how can these funds be best mobilised, allocated and utilised for maximum effect and impact?

Private sector investment is still a major gap in financing climate-resilient development in Africa

Approximately 81% of green investments in the developed world are financed by the private sector, demonstrating their commercial viability, compared to 14% in the developing world. Overcoming barriers to private investment lies in providing a stable and predictable regulatory environment, as well as effectively managing offtake risk, which is crucial for attracting investors, as is managing foreign exchange risk. Adding to the challenge, African governments face substantial debt burdens, rendering debt service challenging, which brings to the fore the critical issue relating to the quality of climate finance, in addition to the overall quantity of climate finance.

Due to the inherent high risks associated with climate-related initiatives in Africa, the cost of capital becomes steep and interest rates hinder progress. Data scarcity contributes further to the perceived risk of climate projects, highlighting the need for comprehensive data to assess risks and potential returns on investments accurately. While opportunities are abundant, realising their full potential requires scaling projects effectively and scalability remains a key challenge. Achieving scale requires substantial long-term investments. Unfortunately, the perceived investment risk in Africa often hinders the possibility of such long-term commitments.

Long payback periods

Long payback periods for climate projects pose a problem, in making 'ready-to-order’ investment cases as investors often seek shorter-term returns. There is a significant mismatch between long-term investment returns and the urgent needs of climate projects, posing a challenge for sustainable funding. Climate projects typically have long payback periods- the challenge that typical investors have is their need to report performance on a shorter term (e.g. annual) basis – not a long-term basis. Investors will look for shorter projects that can report returns in one to three years, yet the challenge is that you need long-term projects to achieve the required scale and developing project pipelines remains an additional challenge. Therefore, the problem is that you need long-term projects to achieve scalability and scale in access to finance, yet the appetite for long-term investing is lacking. This discrepancy necessitates a shift in how performance is reported and how finance is better structured to enable investors to evaluate projects long-term rather than focusing solely on short-term returns.

A multifaceted approach

A multifaceted approach is crucial, aligning spending on development aid with climate priorities, de-risking investments through public finance and fostering a conducive environment for private sector participation. One significant gap that needs immediate attention is the need for more risk-tolerant capital to support early-stage project development. Just as financial technology (fintech) start-ups received a boost from such financial support, climate change investments urgently require a similar injection of funding. Bridging this financial gap is crucial to kick-start projects that can have a lasting impact on mitigating climate change effects.

Key elements in financial transformation

A key element in this financial transformation are structural reforms of Multilateral Development Banks (MDBs) and International Financial institutions (IFIs), including public investment funds. These institutions play a pivotal role in de-risking and mobilising private finance, making it vital to enhance their frameworks for a more conducive investment climate. However, governments must be willing to undertake calculated risks to attract private investors. This entails creating an enabling environment where governments are prepared to back early-stage projects and shoulder a portion of the associated risks. This enabling environment must encompass three important traits: transparency, consistency and longevity in the incentives and frameworks supporting private sector investment.

Credit ratings wield significant influence over attracting capital, as expressed by institutions like AfriExim Bank. Institutions must be aptly structured to garner further capital and provide compelling narratives to their development partners. This also extends to developing bankable projects, presenting a viable demand for investment. In addition to these measures, insurance products and credit and foreign exchange guarantees are pivotal in de-risking investments and attracting private sector involvement. Institutions like the TCX Fund have demonstrated how reducing currency risks in emerging markets can enhance investor confidence by diversifying these risks. Addressing the concerns around currency risks is vital for African countries to utilise their currencies for development. Noting the relatively shallow African capital markets, the role of specialist funds to facilitate investment financing through local currencies is necessary to empower the region to utilise its financial resources effectively and build resilient local financial ecosystems. Philanthropic capital could also hold some promising potential in de-risking projects and scaling African solutions, especially in the domain of adaptation finance. Whatever the source, the quality of finance matters and climate finance strategies should be tailor-made to suit the African context, focusing on financial reform and exploring opportunities to minimise risks, enhance viability and offer technical assistance.

Funding gaps

A substantial funding gap persists in climate finance, primarily stemming from a disconnect between perceived risk and the actual risks associated with climate-related initiatives. Bridging this perception gap is crucial to attract the necessary funding. We urgently require de-risking solutions that accurately address the real risks, providing investors with a clearer understanding of the potential risks involved.

Early stage adaptation investments: e.g. Acumen Resilient Agriculture Fund (ARAF) and Kawisafi

Early-stage investment in adaptation projects is crucial in addressing this gap. Initiatives like ARAF and Kawisafi play a significant role by providing funding and support at the early stages of climate adaptation projects. These efforts are essential in bridging the gap between innovation and large-scale implementation, ensuring impactful climate solutions. By aligning perception with reality and implementing effective de-risking strategies, we can close this funding gap and drive substantial investments into climate initiatives essential for a sustainable future. Addressing risk perceptions would also have the potential to significantly improve the ability to ensure that finance reaches the local level where it is needed most, including to MSMEs and social enterprises.

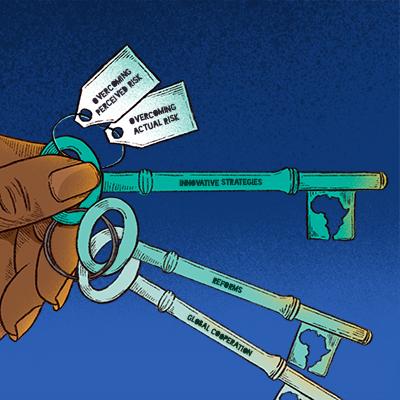

The climate finance gap in Africa demands innovative strategies, reforms and global cooperation. By aligning financial instruments, de-risking investments and promoting a conducive environment, Africa can harness its vast potential to effectively combat climate change and work towards a sustainable and resilient future. Unlocking climate finance for Africa also demands a concerted effort to improve the quality of finance, scale impactful projects and harness the potential of Africa's vast resources and youthful population.

What was also evident from attending the various events at ACW was that while the perceived risk presents a gloomy outlook for investment in addressing climate change on the continent, several proactive initiatives and institutions are implementing innovative approaches to addressing this risk. Worth noting is that it is always important to look at the positive actions that banks, insurance institutions and private investors are taking to drive climate investment on the continent.

Notable initiatives and strategies

While there are too many to mention, some notable initiatives and strategies employed by organisations to promote sustainable development and climate resilience across Africa were discussed at an ACW and getting finance to where it is most impactful.

CRDB's innovative insurance product for smallholder farmers

The CRDB recognises the vulnerability of smallholder farmers to climate-related risks and has pioneered an innovative insurance product. This initiative not only supports the farmers in securing a more stable income stream but also enhances bankability by minimising capital loss exposure for the bank.

Climate resilience through the Infrastructure Climate Resilient Fund (ICRF)

The ICRF is a pioneering effort to de-risk investments and attract private investors into climate-resilient infrastructure projects. By providing first-loss capital, this initiative makes it more feasible for local institutions to develop innovative financial products and encourage private investment in critical climate-resilient infrastructure.

Closing the gap: Addressing risk perception and real risks

A significant barrier to adequate funding for climate initiatives lies in the disparity between risk perception and actual risks. Bridging this gap requires de-risking solutions that accurately address real risks associated with climate action. Understanding and effectively managing these risks makes attracting the much-needed investments to drive climate-positive economic growth possible.

Equity as a catalyst for climate-positive growth

Private equity emerges as a powerful driver in steering climate-positive economic growth. It provides the needed liquidity and returns while effectively managing risks associated with climate investments. Infusing equity into climate-resilient infrastructure can significantly accelerate progress, ultimately steering us towards a sustainable and climate-resilient future.

In conclusion, Africa’s need for climate finance is substantial and requires a paradigm shift in financial strategies. The private sector's role is critical, yet barriers such as perceived risks, long payback periods and gaps in early-stage project funding persist. De-risking solutions, innovative initiatives and global cooperation are identified as essential to bridge the climate finance gap and propel Africa toward a sustainable future. The Africa Climate Week showcased proactive measures and initiatives, emphasising the positive actions of banks, insurance institutions and private investors in driving climate investments across the continent. We need to explore innovative financing approaches, many of which exist and are being applied, to address risk perceptions and embrace equity as a catalyst. Importantly, we need to scale these context-specific examples of already tested innovative financial models, while emphasising the execution of these in partnership with local FIs. The challenge and the solution lies in aligning risk perception with reality, implementing effective de-risking strategies and fostering a conducive environment for impactful climate solutions in Africa.

Disclaimer: The thoughts and opinions expressed in this communication are solely those of the individual or entity to which it is addressed and may not necessarily reflect the views of others. Any information contained in this communication is for general informational purposes only and should not be considered as professional advice. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability concerning the information, products, services, or related graphics contained in this communication.