Index-Based Mortality Livestock Insurance in Mongolia

Index-Based Mortality Livestock Insurance in Mongolia

Key messages

- Index-based insurance for livestock mortality has helped herders in Mongolia to build their resilience against climate-related risks, such as extreme weather events like dzuds.

- Traditional insurance is often not available in large, sparsely populated areas like Mongolia, but index-based insurance provides financial security to populations in these areas.

- An index-based insurance programme must be based on high quality data, as well as be affordable for both the purchasers and the companies selling the insurance. Potential buyers of the policies must understand the benefits and logistics of the insurance.

- The Government of Mongolia is trying to form a comprehensive risk management strategy, which includes encouraging herders to adjust the number and types of their animals to meet pastureland’s carrying capacity. Insurance is but one part of such an approach.

Harsh and unpredictable weather, exacerbated by climate change, makes herders in Mongolia vulnerable to mass livestock losses. In 2010, over 50% of Mongolia’s herders were affected by extreme weather, with 75,000 herders losing more than half their livestock. About 33% of the country’s workforce are herders, leaving many Mongolian households – and the nation’s economy – vulnerable to shocks affecting livestock populations. The Government of Mongolia’s Index-Based Livestock Insurance (IBLI) Project, supported by the World Bank, developed an innovative index-based mortality livestock insurance now available in every Mongolian province. Index-based insurance programmes aim to make payouts based on an index of aggregated criteria, such as livestock losses over a geographic area, rather than households' or businesses' actual, individual losses. IBLI protects Mongolian families from significant livestock loss by providing financial security, while also encouraging herders to adopt practices that build their resilience to extreme weather events. In 2012 alone, herders bought 16,000 insurance policies. This brief demonstrates how an insurance programme such as IBLI can be used as part of a strategy to protect populations from climate-based risks.

Breeding and raising livestock for meat, milk and cashmere constitute an integral part of Mongolia’s economy. The agriculture sector accounts for about 15% of the country’s gross domestic product, and roughly 80% of the value added is livestock. In 2011, Mongolia’s National Statistical Office counted about 36 million head of livestock. This large number of animals using common grazing land has led to increasing degradation of grasslands, making livestock more vulnerable to dzuds (harsh weather events that consist of drought, heavy snowfall, extreme cold and windstorms). Degraded grasslands can no longer provide sufficient vegetation, so when dzuds occur there are not enough nutrients to sustain the livestock.

The International Panel on Climate Change (IPCC) has demonstrated that climate change is exacerbating extreme weather events worldwide and negatively impacting vulnerable populations. The IPCC’s Special Report on Managing the Risks of Extreme Events and Disasters to Advance Climate Change Adaptation (SREX) has found that “a changing climate leads to changes in the frequency, intensity, spatial extent, duration and timing of extreme weather and climate events, and can result in unprecedented extreme weather and climate events”. The SREX case study on dzuds found that this impact applies to Mongolia. These more severe weather events – droughts, changes in rainfall patterns and floods – have a particularly significant impact on agriculture. An increase in temperature of almost two degrees Celsius in the past 50 years and increasingly unpredictable precipitation patterns has negatively impacted the pastures that Mongolian herders use for their livestock by increasing the intensity of droughts and dzuds. In addition, Mongolian herders themselves have noted how the sudden cold spells and changing rainfall patterns have caused greater livestock deaths. In order to help herders cushion the effects of climate change and desertification, the government of Mongolia is encouraging the transfer of information and technology to herders. The government is also promoting research on sustainable herding methods to protect pasturelands, education of relevant stakeholders on adaptation methods and sustainable practices, and coordination of research and monitoring.

Establishing index-based livestock insurance in Mongolia

The dzuds that occurred between 2000 and 2002 prompted the Government of Mongolia and World Bank to explore solutions, which led to the establishment of IBLI in Mongolia. During this period, over 11 million animals died, representing a loss of over US$200 million. It also led to an increase in the poverty rate from approximately 30% in 2000 to over 40% in 2004. This climate-related risk called for a strategy that allows the risk to be shared among communities, insurance companies and the Government. The Government, with help from the World Bank, responded by creating an innovative insurance program – the first to pay out based on livestock mortality rates – that has reduced risk for thousands of Mongolian herders. Drawing on historic data on livestock losses, Mongolia developed a livestock insurance scheme that combines self-insurance, market-based insurance and a social safety net.

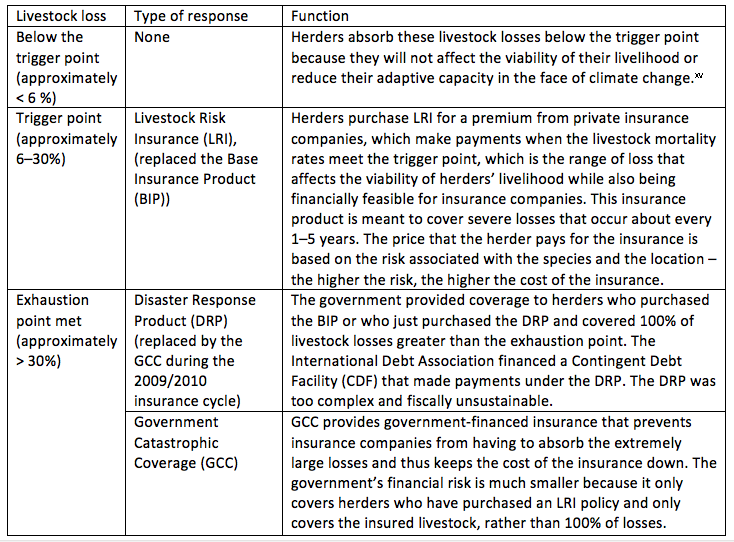

The table below explains when and how herders receive payments for losses of livestock.

Project implementation costs are just under US$10 million (not including the CDF) for the entire duration of the project. This funding has been spent on promoting public awareness, building institutional capacity, monitoring and evaluation of implementation, project management and scaling up of the insurance. This investment has protected thousands of herders from devastating losses: 100% of qualified herders have received payments from the private insurers after suffering devastating losses from dzuds in 2009 to 2010. Currently, five insurance companies are participating in IBLI in Mongolia and almost 10% of herders have purchased policies. After devastating losses in the dzuds from 2008, about US$340,000 (MNT 389 million) was paid to 1,783 herders – only a small amount of which came from the government coverage.These payments helped protect herders from catastrophic losses that resulted from the impacts of extreme weather events and prevented thousands of herders from falling into abject poverty. The project has been extended until March 2014 with the last insurance cycle to be completed by August 2013.

Benefits of index-based livestock insurance

Weather-related risks deeply affect low-income populations through famine, displacement and devastating financial and/or property losses. As a result, these risks are a disincentive to poor families to invest in their livelihood activities, making it harder to change their economic status. Insurance is an important mechanism that allows poor households to invest in strategies with higher economic growth potential that will help shield them from the impacts of climate change. However, insurance is often not available to low-income populations because insurers do not know or cannot quantify their agricultural risks. This is especially true in locations where climate change is expected to have substantial but uncertain long-term impacts. In Mongolia, it is difficult to create a market that is substantial enough to adequately pool risk within a small, sparsely populated group. Even where insurance is available, usually only wealthier population segments can afford it, allowing income disparity to grow.

Index-based insurance can resolve many of the inequities and challenges that are presented by traditional insurance. While traditional insurance pays based on insurance agents’ individual assessments of loss, index-based insurance reduces transaction costs and avoids the problem of moral hazard by providing a system of payment that is automatically triggered when a mortality threshold is met. Index-based insurance can also provide a tool to help herders soften the impact of weather events that are made more severe by climate change. Additionally, index-based insurance provides an alternative to a reactive approach to disasters that relies mainly on domestic money diverted from other projects and international donations. This reliance often stems from a lack of understanding about risk and economic incentives and an underdeveloped insurance market. This type of diverted domestic funding can be delayed before disbursement, or can be insufficient and ineffective due to its ad hoc distribution. Even though disbursement of IBLI payouts can also be delayed, IBLI often allows for funds to be readily available as part of the insurance pool and distributed faster than emergency aid.

To be most effective, index-based insurance should be part of a comprehensive risk management strategy that aims to reduce the risk in the livestock sector by establishing sustainable practices to better manage the pastures where livestock graze. For instance, sustainable grazing practices prevent desertification and land degradation, making livestock less vulnerable to harsh weather events. Index-based insurance provides an important method for incentivising herders to adopt sustainable grazing practices that reduce their risk. Two options for accomplishing this are price signals (e.g. charging lower premiums for diversifying the types of livestock owned) and risk management stipulations (i.e. requiring herders to take certain actions to lower their risk as a condition of the insurance). The Government of Mongolia is trying to build climate resilience at the community level by promoting adaptation and reducing risk. This approach includes:

- encouraging the adoption of rain and flood water harvesting techniques

- using traditional knowledge to adjust the animal types and numbers to the carrying capacity of pastureland so that the pastures can sustain them

- introducing animal breeds that are more resilient to climate change

- improving veterinary services to prevent animal diseases in herds throughout the country

- forming herders’ groups and pasture management teams to sustainably manage pasturelands.

Key lessons

Index-Based Livestock Insurance in Mongolia demonstrates that index-based mortality livestock insurance has the potential to generate economic benefits and increase resilience to climate change. However, this approach is not without challenges, such as ensuring affordability. Lessons learned that can inform the future of IBLI in Mongolia and its application in other countries include:

1. High quality data on livestock mortality are critical

The Mongolian Government has conducted a livestock census, a procedure protected by several laws, every December since the 1920s. Without a proper understanding of mortality rates, payments by the insurance companies will either be too little, which will not alleviate the catastrophic impacts of dzuds, or too much, which will make the programme unsustainable for insurance companies. Additionally, the pilot project worked to understand the data process, which resulted in obtaining valuable information about the herds. For instance, knowing that local government leaders are familiar with the herders and their livestock helped the creators of the programme with counting and reporting issues. The U.S. Department of Agriculture’s National Agricultural Statistic Service has provided advisory services to the project. This help has allowed Mongolia’s National Statistics Office to effectively implement a mid-year survey.

2. Education and training are both key to stimulating demand for livestock insurance.

Complex index-based insurance products can be difficult to understand, especially for populations with low literacy rates and little or no previous insurance experience. While this has not been a problem in Mongolia because of its high literacy rates, other countries attempting to implement similar insurance programs, such as Kenya, will need to be aware of this issue. The Mongolia IBLI project included a comprehensive advertising and education campaign to help inform herders about this type of insurance. These outreach activities included television and print advertisements and promotional materials such as pamphlets and face-to-face education that reached a large number of herders. Further information will become more readily available as internet and cell phone access expands, giving herders greater access to information that will allow them to better manage risk. Insurance agents and staff must be able to properly communicate terms and conditions of the insurance policy as well as describe how the index-based payments are calculated after the occurrence of mass livestock deaths. Proper outreach is critical to building herders’ understanding of and confidence in the system.

3. Insurance needs to be affordable for individual herders

Index-based insurance is more affordable than traditional insurance because it eliminates high transaction costs through automatic disbursements of payments. Several factors in Mongolia present issues that could cause insurance to become prohibitively expensive. First, the uncertainty associated with climate change could make insurance too expensive as insurance companies raise prices to cover unknown risks. Second, affordable insurance is key to ensuring that herders cover a sufficient percentage of their livestock so in the case of severe losses they will be properly protected. Currently, most herders only have only about 30% of their livestock insured. Finally, insurance might become unaffordable as herder household incomes are lowered by decreasing value of or reduced demand for their product. For instance, the reduction in the price of cashmere, which is an important textile product for many herders, had detrimental effects on the incomes of herders in Mongolia. The price per unit of raw cashmere fell almost 50% between 2008 and 2009, but was quickly offset after the Government of Mongolia removed an export tax and opened border posts for trading cashmere. While this did not seem to have affected the herders’ willingness to buy the insurance – partially because animals’ values have increase by 30% since 2010 – more significant financial losses could make it impossible for herders to afford the insurance.

4. Implementation must be cost effective and well governed

In order for an IBLI programme to be successful, implementation must be affordable for insurance companies. The premiums are currently affordable for many herders as evidenced by the fact that they have been able to insure over 3.2 million animals between 2006 and 2010 from approximately 175,000 households. In order to keep the premiums affordable, these insurance systems must have a cost-effective administrative infrastructure. Premiums could be brought down even further if insurance agents do not have to sell the insurance products throughout large geographic areas. The actual process of selling and purchasing the insurance could implement changes that would allow agents to save time and money by not needing to go to the individual herders. Offering the insurance at bank branches or via mobile phones might improve the process. The programme has attempted to improve efficiency by allowing insurance companies to offer discounts to herders who automatically renew, but so far herders have not chosen to do so. Additionally, scaling up the project so that more people buy insurance policies will also make them more affordable because the risk pool will be larger, bringing the costs down. Fraud can also increase the costs of implementation, but many checks and balances (e.g. maintaining multiple records of these sales and payments) have minimised this problem.

Implications for the success of an index-based program

Domestic insurance programmes can help developing countries build resilience to climate change by allowing herders and government officials to better evaluate and manage economic risks associated with extreme weather events. Insurance is an integral part of reducing and managing climatic risks and is gradually being used more and more in developing countries. Key implications of the index-based livestock insurance programme in Mongolia include:

- Index-based livestock insurance is an effective method of distributing the risks associated with dzuds and other extreme weather incidents. These extreme events have important implications for major economic sectors in Mongolia, but IBLI has allowed herders to better manage their risk and adapt to the impacts of climate change.

- In order to be most effective, index-based insurance should be one part of a comprehensive risk management framework that aims to encourage sustainable livestock practices that decrease herders’ vulnerability. Other elements of such a framework would include improving veterinary services to prevent animal diseases and improving access to water in drought-prone areas.

- Index-based insurance is playing an important role in helping Mongolia and other developing nations adapt to climate change and adopt more sustainable forms of agriculture by signalling the economic risks and incentivising best practices. For instance, studies have shown the applicability to other countries with substantial pastoralist communities such as Kenya.

- Strong public–private partnerships are necessary to offer affordable insurance products that herders want, limit the Government’s economic risks and protect the domestic insurance market from catastrophic losses.

Photo courtesy of Chiakto / Shutterstock.com