Clean energy without currency risk

Clean energy without currency risk

Harald Hirschhofer of TCX says that foreign exchange risks have caused a hurdle to rolling out renewable energy technologies in some countries. But now development finance institutions are helping firms manage the risk and expand their operations.

Never before has access to energy for the world’s 1.2 billion poorest been in such close reach as today. Replacing kerosene and other high-cost carbon based energy sources with clean and reliable energy of the sun is not only an imperative but also an extremely promising business opportunity. Efficient solar panels, increasingly affordable energy storage technology and close to universal access to mobile banking, have broken down access barriers to roof-top solar solutions. This technology driven revolution will provide employment for many, lift even more people out of poverty, put developing economies possibly on a higher sustainable growth path, and achieve all this in a climate friendly way.

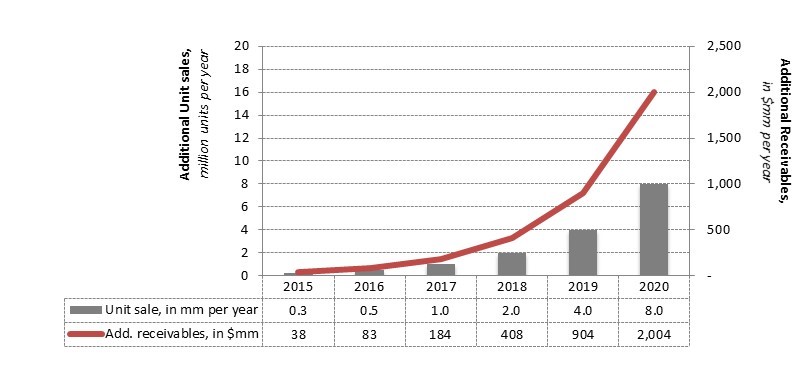

The decline in the cost of roof-top solar systems and pace of technology roll-out are stunning. Experts expect costs decline to continue and sales to accelerate sharply. Several roof-top solar companies operating in Africa are now connecting more customers per month than during the entire year 2013. Their internal growth projections are above 100 percent per annum for the foreseeable future. Table 1 shows aggregate growth projections of existing roof-top solar providers are expected to reach 8 million units in 2020, not yet taking into account the emergence of new powerful market players such as traditional utilities or oil companies seeking to diversify away from carbon.

Source: Persistent Energy Capital, www.persistentnrg.com

Overcoming the exchange rate challenge

We can provide access to clean energy even faster when we tackle a few remaining financing challenges. One of these is the exchange rate risk that roof-top solar companies are creating on their balance sheets. Because of the absence of longer-term fixed rate local currency financing, these companies often take US dollar-denominated loans to finance the purchase of home-solar equipment bought in bulk. They, in turn, sell piece by piece to households and small enterprises either with an instalment- or lease-purchase contracts denominated in local currency. Moreover, many roof-top solar companies are increasingly considering the possibility of contractually setting repayment amounts for their customers. Such consumer protection makes good business sense: low income customers benefit from more stability in their disposable income and the gained financial predictability may allow households to purchase more of the new technology sooner. This is a win-win - especially if one compares this to the plight of the many “privileged” utility customers in Africa, who not only suffer from regular black and brown-outs but also from huge jumps in their monthly bills due to fuel and foreign exchange surcharges imposed with zero predictability.

However, the mismatch from financing in one currency and selling in another imposes potential stress on the roof-top solar sector and their business model. It makes planning more difficult, increases financing costs and constrains the size and repayment periods of retail contracts.

Delivering solar roof top applications in remote locations is already a complex task. Supplies need to be sourced and imported, distribution and client service networks built up, payment systems put in place, financing secured, etc. Assessing macro-economic global and country specific risks that drive the exchange rate may well be one task too many (especially if little can be done to influence outcomes). Eliminating or reducing foreign exchange risks makes financial and business planning and implementation, easier. Managers can focus on their business and on aspects they are in a better position to influence.

Foreign exchange risk also increases the costs of credit as its balance sheet impact can be substantial. A condition often experienced in recent months. Major currency swings can mean the end for an otherwise well-planned and managed business. For a representative average roof-top solar company, an unexpected 10 percent decline in the foreign exchange rates could wipe out as much as one third of expected profits. Combined with only a few years of operating history, this vulnerability adds up to challenging funding discussions with banks and finance institutions. The latter are increasingly asking for sustainable approaches to minimise foreign exchange risks and to strengthen financial stability.

[caption id="attachment_62433" align="alignleft" width="300"] Solar power transforms village in rural India (DFID)[/caption]

Solar power transforms village in rural India (DFID)[/caption]

Providing long-term solutions

The lack of long-term local currency financing and foreign exchange risk hedging instruments also constrain flexibility in what payment plans can be offered to customers. This negatively influences how easily the poor can afford access to solar energy. Some roof-top solar companies now seek to get the equipment fully repaid in one to two years, which combined with tight monthly household budgets, put limits on the type and quality of technology that can be offered. Improving local currency financing and hedging conditions would allow stretching repayment periods.

Some donors and financial institutions are now developing sources for longer-term local currency financing and adequate hedging instruments. Dedicated funds will provide long-term working capital financing in local currencies to supplement the local banking system and nascent capital market solutions. However, foreign investors will still seek to hedge their foreign exchange exposure.

Therefore, the German Ministry of the Environment has invested Euro 30 million into TCX, an Amsterdam based global foreign exchange risk pool operator. TCX has the mandate to provide suitable foreign exchange hedging solutions to support solar roof-top financing and other renewable energy initiatives. In 2008-2015, TCX achieved a transformational impact in the micro-finance industry and will now apply its expertise and balance sheet to support clean energy investments. TCX will work with local financial institutions, development finance institutions, specialised funds and the solar roof-top companies, to improve the management and allocation of exchange rate risks in the sector. It will provide risk pricing to assess the fundamental viability of business models as well as the instruments to hedge those risks, mainly cross-currency swaps and forwards at an adequate scale.

We hope that TCX will succeed in crowding in other private risk capital to jointly taking on exchange rate risk. The initiative will accelerate scaling up of the solar sector and improve access to zero carbon energy and energy efficient appliances in the poorest regions. Innovative financial products and new technical solutions will work together to accelerate development and fight climate change.

Image: credit Minoru Karamatsu