Government action needed to accelerate green business in Asia

Government action needed to accelerate green business in Asia

In this article, Sandra Khananusit, CDKN's consultant highlights the key points of a debate on the potential of initiating and strengthening green businesses in Asia, focusing on how the governments of the region can engage with the private sector and create an enabling environment for the private sector to invest in low emission development strategies and NDCs.

Given strengthened global and national climate change agendas around the Paris Agreement, the focus on mobilizing finance – public and private, domestic and international – to implement countries’ nationally determined contributions (NDCs) and to realise the greenhouse gas mitigation targets that they contain has never been stronger. Through the Asia LEDS Partnership, a regional network of policymakers and practitioners driving low emission climate resilient development, national government members from across Asia’s developing countries have named their top challenge – and the issue they would like support on most urgently – as to how to deepen engagement with the private sector to increase private sector participation in financing low emission development strategies and NDCs.

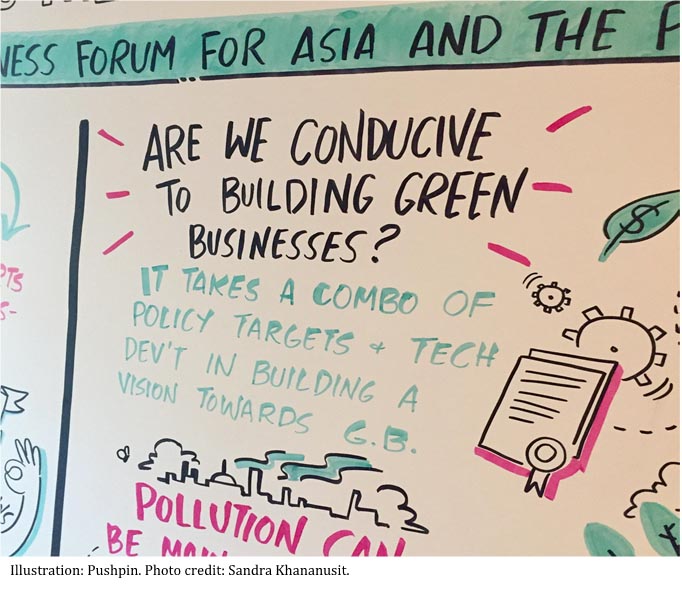

This week, the CDKN, an active member of the Asia LEDS Partnership, attended the Asian Development Bank’s (ADB) First Green Business Forum: Investing in a Sustainable Future to engage in discussions with business leaders towards understanding how CDKN and the Asia LEDS Partnership can support governments to better enable private sector action towards achieving climate goals.

The Green Business Forum concluded with a number of takeaways to plant the seeds for action by all sectors towards accelerating green business in Asia. In the closing session, Diwakar Gupta, Vice-President for Private Sector and Cofinancing Operations at ADB, summarised as follows.

- There is a high potential to scale up green businesses in Asia. Asia’s share of the USD1.3 trillion environmental goods and services market is 22%, and the rate of growth of this market in Asia is about 3.5% annually – faster than any other region. Trends show continued growth in traditional sectors such as energy efficiency and renewable energy, and opportunities to grow in emerging sectors – such as sustainable agriculture, sustainable fisheries and aquaculture, sustainable forestry, and sustainable tourism.

- Greener technology is driving the shift to sustainable production and consumption, and consumer demands for environmental stewardship and sustainability should be seen as a business opportunity – not a cost. One venture capitalist described his profitable investments in agri-tech software companies in Sri Lanka to help farmers make production decisions, manage supply and thus ensure good prices, link farmers to buyers directly to facilitate pre-purchasing, and offer traceability in response to growing consumer demand for responsible production practices.

- In communicating to private sector, advocates must encourage the transformation to green business using language that private sector understands – highlighting direct benefits to business operations and strategy. For example, through environmental economic analysis, a real estate investment trust in Hong Kong recognised the environmental risks inherent in their business and issued USD500 million in green bonds to support green building and energy efficiency measures in its portfolio and new investments – benefitting its triple bottom line.

- Governments have a key role to play in providing policy and regulatory frameworks that incentivise and enable private sector action – leveraging a mix of command and control standards, market-based approaches, and voluntary approaches as levers.

Expanding on this last point, across sessions at the event, businesses, investors, and experts shared thoughts on how governments can provide the enabling environment needed to spur private sector action, and on what actions that governments can themselves take to lead the way.

- Strong leadership and a clear vision from government are essential to promote a shift by private sector towards green business. This can be achieved through methods such as setting clear targets that must be met in the next three, five, and/or ten years so that private sector can innovate to create the solutions that work best for them, to meet targets. As one participant said, “government needs to be a ‘visible hand’ that does more than just ‘nudge’.”

- Governments must adequately mitigate risks perceived by private sector. “Investors want three things: certainty, certainty, and more certainty,” noted a participant. Investors and businesses require predictability, which governments can provide through clear and stable policies and regulatory frameworks – such as on licensing, mandatory investment grade sustainability disclosure, or other areas.

- Providing incentives and positive subsidies for businesses to “go green” are important drivers. For example, years ago the government of Sri Lanka allocated export quotas to rural towns, prompting entrepreneurs to establish businesses in less developed areas – creating jobs and growing the economy. A similar approach can be used to cultivate green businesses. “Naming and faming” leaders in green business can also provide positive recognition to encourage replication and new innovation.

- Governments can identify and nurture their country’s comparative advantages for green business. Secretary Regina Lopez, Department of Environment and Natural Resources of the Philippines, shared that 70% of the biodiversity in the Philippines is only found in the Philippines – presenting a potential green business opportunity. Similarly, 10 Pacific “small island states” redefined their role as “large ocean states,” finding that they controlled 20% of the world’s oceans – another green business opportunity. Changing “mindset” is important to spot an opportunity and to mobilise attention and resources to cultivate it.

- Governments can demonstrate returns in emerging sectors. On natural capital, pubic investment has been limited and government engagement with the development community on projects has largely been grant-based. Governments can identify project opportunities for which to seek “co-investment resources” rather than grants from the development community, to showcase that returns are possible and lead the private sector by example.

In sum, “it’s not about governments taking big steps or small steps – but rather effective steps,” noted one participant. Policymakers agreed, emphasizing that government must identify and prioritise leverage points in which to intervene to influence system changes – and embed appropriate incentives in the system so that green choices are the pathway that make the most business sense.

Organizations such as CDKN and other development partners can play an important role in supporting governments to identify these leverage points, co-designing interventions to meaningfully incentivise private sector in supporting government climate targets, providing technical assistance to implement potentially scalable interventions to create working models, and supporting aggregation of opportunities to achieve the scale of transactions and impacts sought by the public and private sector alike.

Regional networks such as the Asia LEDS Partnership have a similarly important role to help scale up green businesses in Asia. The ALP is a well-established regional network, with infrastructure for regularly engaging with country governments on LEDS and NDCs to collect information on country-based challenges, deliver support on regional priorities, and elevate learning to the regional and global scale. Building on this strong structure, the ALP can support green business growth by introducing working models from the global community to Asia, helping to adapt models for application in Asia, and facilitating peer learning on experiences accumulated in Asia to encourage adoption and replication of suited strategies. The ALP is currently developing its work plan for 2017, and will continue to identify ways to facilitate greater understanding between governments, businesses, and investors to increase private sector participation in financing LEDS and NDCs.