CDKN seeks your views on green growth – part 4

CDKN seeks your views on green growth – part 4

In part four of CDKN’s exclusive discussion series on green growth, our Executive Chair Simon Maxwell seeks your views on what green growth means for developing countries. Simon has put together ten propositions on green growth, and will be answering your questions and comments on two propositions each week, this week and the following week. Visit Ten observations on climate change and growth to read the paper in full, and read last week’s discussion here.

In part three of this discussion series, we looked at the feasibility of low-carbon growth in the developing world, and considered the need for a flexible and competitive economy.

This week, Simon suggests that developing countries need to link climate policies to growth, and considers the need to leverage private finance for green growth strategies.

Read Simon’s two propositions, and let us know if you agree by commenting in the box below.

7. Link climate policies to growth

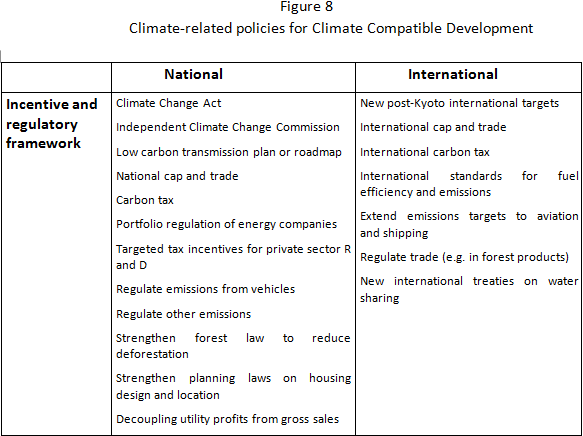

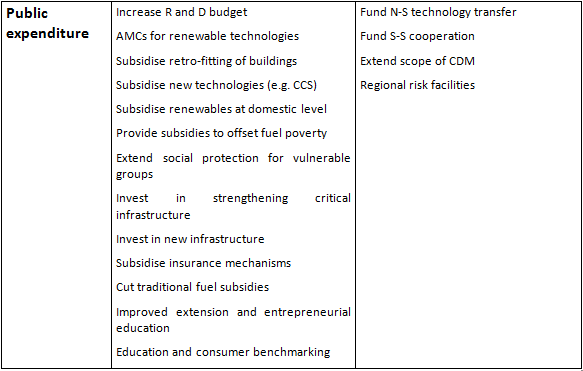

The ODI study referred to earlier looked at the impact of developed country mitigation policies on developing countries, concentrating on trade-related measures. Developing country governments will be choosing policies from a wider set, a first listing of which is to be found in Figure 8. This distinguishes policies related to the incentive and regulatory framework from those concerned with public expenditure, and national policies from international. Countries can choose different combinations of policies, as the examples of the UK and Indonesia illustrate (Box 1).

Box 1

Climate Change Policy-making in the UK and Indonesia

8. The priority for funding is to leverage private flows

An important conclusion from the preceding discussion is that the definition of climate financing needs to have porous edges, recognising that countries need to be supported in a wide range of adjustments to changing global economic circumstances, some of which may not at first sight seem directly climate-related. As the work by WEF has recognised, climate-related growth policies have strong links to industrial policy more widely.

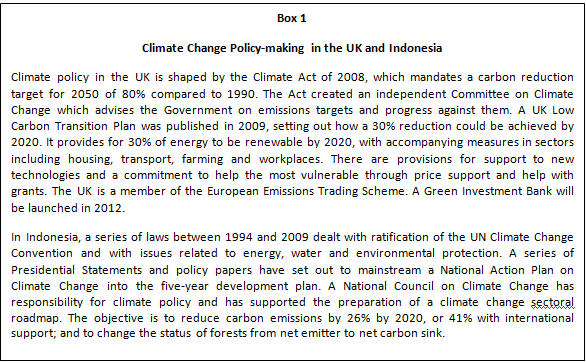

Many other issues arise in relation to climate finance. The Advisory Group on Finance, which reported at the end of 2010, was charged with mapping how the $US100 bn of ‘new and additional’ public and private finance foreseen by the Copenhagen Accord might be raised. A range of options was identified, summarised in Figure 9. Public sources included direct budget contributions and a variety of tax-based instruments. Other sources include carbon markets and private capital.

Figure 9

Sources of climate finance

Source: Advisory Group on Finance

Monitoring is a major issue, addressed by initiatives like Climate Funds Update. Not surprisingly, it proves easier to monitor public funds than private. Beyond monitoring, issues arise in relation to:

- Additionality – with many possible definitions still being debated, and an increasing likelihood that little genuinely new money will become available.

- Architecture – especially related to the tension between seeing climate transfers as entitlements rather than aid, with corresponding implications for governance and the role of donors.

- Conditionality – with the clear implication that transfer payments should not be subject to conditions by donors.

- Absorptive capacity – with the lesson from aid funding (and from commodity price surges) that a sudden inflow of foreign exchange can lead to Dutch disease, which harms productive sectors, unless additional funding is directed specifically to supply-side investments.

- Predictability and accountability – especially in relation to the volume and timing of public flows.

From the perspective of growth, the basic principles of aid effectiveness apply, especially the importance of country ownership, alignment behind Government plans, harmonisation of procedures, and mutual accountability. From the perspective of outside funders, a key pre-condition is the existence of a strong and credible policy framework, described in the WEF scaling-up report as an ‘investment-grade’ policy framework.

Investment grade policy is also a requirement for private sector engagement, and, given the size of private flows, the question of how to secure the necessary private investment in low carbon development is arguably the most important new aspect of the finance debate. The key terms is ‘leverage’ – concerned with using public money to encourage or ‘crowd-in’ private investment. A ration of 18:1 is sometimes discussed – meaning that every pound of public money will result in 18 pounds of private investment.

Some of the ways to achieve this are well known. Aid donors are used to making investments in infrastructure as a way to encourage private investment, and have experimented with challenge or innovation funds to reduce the risks for business partners. Multilateral development banks and Development Finance Institutions are well-versed in blending grant and loan finance, providing loan guarantees, and using equity stakes in private business as a kind of quality guarantee for other investors. Newer instruments involve hedging foreign exchange or regulatory risk, so as to reduce the perceived disincentives to doing business in developing countries.

It is important to emphasise that the private finance to be attracted into low carbon growth will be national as well as international, involving small and large businesses in developing countries themselves. That is why countries such as the UK are exploring the value of a domestic Green Bank, to specialise in this area.

Photo courtesy Millennium Challenge Corporation